Attentive to Income tax reform being proposed, it makes sense to concentrate, in a single text, the main concerns that we have attended to clients who live in another country, but intend to maintain or invest in Brazil by living abroad. There are some novelties, brought not only by the PL 2.337/2021but in the future also by the Central Bank, which could bring changes for these customers.

This text will be divided into 3 parts:

- why a person, when moving abroad with their family, decides to invest or else maintain financial investments in Brazil;

- which financial strategies a person who wants to invest in Brazil while living abroad usually follows;

- what the difficulties are that this person finds so that they can regularly maintain their financial investments; and

- what changes are on the horizon that can favor the investors living abroadI'd like to talk to you about both the IR Tax Reform and the change in Central Bank regulations.

First of all, the aim of this text is to serve as a easy reference for those who intend to invest in Brazil while living abroad, despite the practical difficulties that the Brazilian system creates. I would also like to share my personal experience, as well as that of our team, with the main practical problems experienced by those who want to build their personal and family wealth.

Who wants to invest in Brazil while living abroad?

Since November 2018, when this blog appeared, I have been grateful for the profound experience of serving so many people with financial investments in Brazil. This allows me to summarize, in a few profiles, what the main reasons for people to decide to keep (or increase) their financial investments in Brazil:

-

Prepare for a possible return to Brazil:

Many families move abroad with a view to returning to live in Brazil at a later date, either because the move abroad is temporary or because they intend to return to Brazil in the long term to live out their retirement. For those who have this plan, maintaining (or increasing) their financial investments in Brazil is undoubtedly a way of saving money. save resources for a future return.

-

Prudence:

It's very common, at least in the first few years, for families who have moved abroad to keep a precautionary savings account in Brazil: a protection against the consequences of moving abroad, if everything goes wrong abroad, can remake their lives back in Brazil. However, with life abroad more stable, this goal may change.

-

Avoid exchange losses:

In the same way, it's also common to keep financial investments in Brazil to avoid losing money when the real devalues against the US dollar and other foreign currencies. In the same way that people avoid selling a share to avoid losing the money they have invested, keeping money "parked" in Brazil in reals is a bet on the Brazilian economy: if the country improves, the real will strengthen again and there will be no losses.

-

Market knowledge:

Most people keep financial investments with the long term in mind. And investing well in the financial market requires some learning. Like it or not, Brazilians knows better how to invest in his own country than abroadThis factor in itself offers investors greater security. Overall, investing in Brazil becomes the standard alternative for many Brazilians, as it is seen as a reasonably safe alternative.

-

Low profitability abroad:

Investors still find higher interest rates in Brazil than abroad, even with the fall in the SELIC rate. It is therefore easy for them to find investments indexed to inflation. As an emerging market, Brazil still promises higher returns than mature markets. Every investor is looking for a balance between profitability and security, which can be found in Brazil (except for the exchange rate risk).

-

Buying real estate in Brazil:

There are still many people who prefer investing in real estate to investing in the financial market, especially when they intend to return to live in Brazil in retirement. In this case, investing in the financial market is a means to an end, i.e. being able to take advantage of opportunities with real estate (building plots, apartments or commercial premises). The advantage is that the property can generate rental income, or the buyer can choose to use it for their own benefit or that of family members who remain in Brazil.

It's rare for a single family to adopt all of the above reasons. But it's quite easy to see that Brazil remains attractive to investors, even with the uncertainties of politics and the economy.

In short, it is our opinion that the above reasons are a symptom of at least some of the following Brazil's institutional maturity. Every investor thinks first in the return on your money and only then in the return on the money investedno matter how lofty the promise.

The Securities and Exchange Commission (CVM), as well as the Central Bank (BACEN), are seen as respectable institutions for regulating the capital and financial markets in Brazil. If there wasn't confidence in investor protection against stock market fraud (CVM) or bank collapses (BACEN), none of this would happen.

Investing in Brazil while living abroad - How do investors behave?

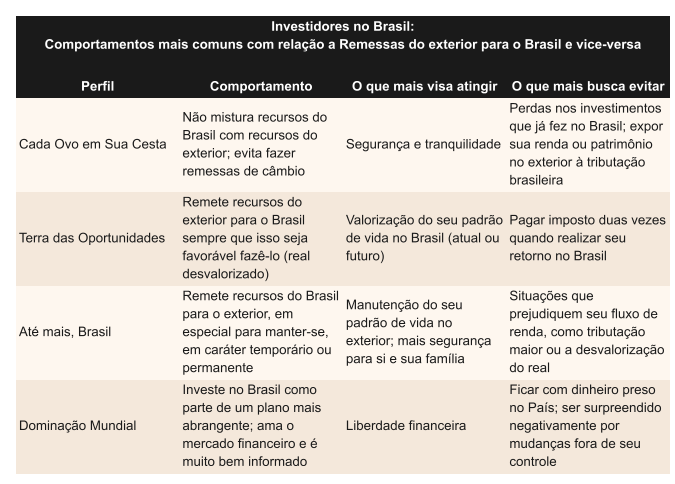

The same experience that makes it possible to find out why people seek to invest in Brazil while living abroad, also makes it possible to draw up profiles of the people who invest in Brazil. strategies followed by investors in the relationship between brazilian investments and investments abroad. Below is a summary table with details of each profile:

1. Each egg in its own basket:

It's the investor who prefers not to mix resources from Brazil with resources abroad. In other words, this profile reinvests all resources in Brazil and rarely remits money from one country to another.

It's the strategy preferred by the most conservativeThis is especially true for those motivated by the intention of making a return, prudence or avoiding exchange rate losses. Money invested in Brazil already runs a currency risk; it's better to consume it in the same currency. Sending funds from abroad to Brazil means increasing the exchange rate risk of investments, which is why it makes no sense for this investor to do so.

In addition, this investor seeks have the security of not losing your investmentsThis is due to both financial factors, such as exchange rate risk, and institutional factors, such as the taxation of investments and the lack of compliance with legislation;

2. Land of Opportunities:

Less conservative than the previous profile, those who see Brazil as the Land of Opportunity prefer to see exchange rate risk as a chance of success: for those who earn in US dollars or euros, it makes sense to take advantage of the devaluation of the real to "buy Brazil"increasing their financial investments in the country.

For this investor, it's important to keep only the funds necessary for the family to live abroad, and send the rest back to Brazil. The funds can be kept abroad for as long as the real is valued, awaiting the next devaluation of the real or the eventual return to the country.

Who intends to stay abroad for a short time usually cultivate this way of thinking, as they are preparing for their return. Even some who intend to stay for a longer period of time sometimes do this and start investing in Brazil while living abroad. This investor looking for peace of mind when making shipments of resources from abroad to Brazil, or vice versa.

3. So long, Brazil:

The exact opposite of the previous strategy, who sees Brazil as his way out needs the resources accumulated in Brazil to maintain their standard of living abroad. The person's moment in life requires exit from investmentsnot new investments.

Two different types of people tend to follow this behavior:

- those who have recently moved abroadand therefore do not yet have financial stability in the new country. In this case, the situation is temporary, after which another strategy is used (usually "Each egg in its own basket").

- who decides to retire abroadThis is usually due to insecurity about crime in Brazil, or to accompany other family members who have already settled abroad. This person has already accumulated most of their assets in Brazil and is unlikely to have new sources of income abroad.

This investor is in time of departure in terms of their investments, so they are more concerned with redemptions from public and private pension funds and their financial investmentsand the best time to send money abroad. The devaluation of the real against the foreign currency is a particularly relevant risk for this person, as it immediately reduces their standard of living. The aim is therefore to avoid events that affect your income flowThis could be due to higher than expected taxation on their income, either in Brazil or in the new country in which they will be living.

4. World domination:

The least common profile, but certainly an important one, are investors who want to maintain a diversified investment portfolio, with resources in different countries. For these investors, investing in Brazil is just part of a bigger plan.

It is more common to find people in this profile who love investing in the financial marketEither because they already work in the sector or because they have decided to dedicate themselves to learning more about it. Many of these investors also invest in crypto-assets, such as Bitcoin (a topic that requires its own text). In any case, this is usually the better informed profile on everything that interests them (politics, economics and legislation).

This investor is less concerned about exchange rate risk. Instead, seeking financial freedomIn particular, you want to ensure that you can easily move your funds from abroad to Brazil, and vice versa, whenever the economic climate changes. You also don't want to be surprised by institutional factors that you can't anticipate in your financial strategy. Examples include legislative changes that create legal uncertainty about the correct taxation applicable to you, or that suddenly increase the cost of your investments.

These profiles are not intended to make a strict distinction between people.

Our purpose is simply to present the results of practical experience dealing with clients. We have, for example, assisted people who have retired to live abroad and maintain a "World Domination" strategy, because they have diversified assets and are not totally dependent on redemptions from financial investments in Brazil.

There will certainly be particular cases not listed above, such as people motivated purely by family factors, and not just by financial strategy (paying alimony, for example). What matters is that the above profiles summarize, in a fairly representative way, what is expected of brazilian institutions (government agencies, banks, brokerage houses, etc.): (i). securing financial freedom to move funds from Brazil to abroad, or vice versa, and (ii). provide legal certainty with regard to keeping accumulated assets in Brazil and also with regard to their taxation.

What difficulties do people who want to invest in Brazil while living abroad face?

Other articles on this blog have already provided information on the difficulties of maintaining financial investments in Brazil, especially for those who want to formalize the loss of their status as a Brazilian tax resident (what we call "tax exit", and the legislation calls "definitive exit" or "temporary exit"). Even so, the issue is complex, and many customers have difficulties to absorb information about all the factors that affect them. So, reader, consider this excerpt as a reference guidewith links to other texts detailing specific points.

A difficulty of those who want to invest in Brazil is not knowing which rules to obey. The questions below are the ones we receive the most, and the answers to which shed light on some of the following myths and truths on the subject:

1. Does living in another country automatically make me a non-resident of Brazil? Do I need to travel to Brazil once a year to avoid this?

Not necessarily. For Brazilians, Brazil adopts a subjective criterion for considering who is a tax resident in Brazil, based on the notion of "definite intent" (which will be written about in the future). For foreigners, rules apply that implicitly include the same notion, in our opinion. Because of this criterion, moving abroad does not necessarily mean becoming a non-resident.

It is important to know whether the person is a tax resident in Brazil or not for two reasons: (i) to know whether or not the Brazilian government can tax income earned abroad; and (ii) to determine the rest of the financial investment strategy in Brazil, given the regulatory difficulties encountered by non-residents.

About permanent exit declarationWe recommend reading our text "Declaration of Final Departure in 2022: what it is and why you should do it".

2. Is my CPF still valid after I move abroad and become a non-resident? Can I lose it?

No. Losing your CPF is a myth. The CPF is only revoked after a person's death. It remains regular even if the person makes a tax withdrawal.

The CPF may no longer be in orderThe CPF becomes "pending regularization" or "suspended" if the Receita Federal system understands, from the information it receives from payment sources and government agencies, that an income tax return was mandatory and has not been filed (CPF pending regularization) or that there are registration inconsistencies, usually with the Electoral Court (CPF suspended).

For those living abroad, the important thing here is to prevent the CPF from becoming irregularor at least know the concrete consequences if this happens. There may be blocking financial resources in Brazil. We talked about this in a section of our text "Declaration of Final Departure in 2021: what it is and why you should do it".

3. If I am a dual tax resident, can I invest in Brazil while living abroad normally?

Yes, dual tax residents are subject to the same taxation as any other tax resident in Brazil. The difficulties in this case are of a different kind:

- income earned abroad is taxed in Brazil and must be declared, as well as the rest of the assets; and

- financial income earned in Brazil may also be taxable in the other jurisdiction in which the person maintains tax residence.

In both cases, it is worth applying Brazilian double taxation agreements or reciprocal treatment between Brazil and the other jurisdiction. The application of one or the other depends on the jurisdiction involved. We've dealt with the subject at length in our article "Living in Brazil and in another Country: Dual Tax Residency, Brazilian Agreements and Reciprocity". In due course, we will produce content aimed at specific jurisdictionsThe United States, Portugal, Germany, Canada, Japan, Switzerland and the United Arab Emirates, among other countries.

4. If I invest in Brazil while living abroad, I will be obliged to file income tax returns to show that I have the investments, even if I have filed a final exit tax return. Is this correct?

This is a myth. In Brazil, the final exit declaration is a special income tax declaration, the last to be filed by anyone. Non-residents do not file income tax returns in Brazil.

Simply put, it's "eight or eighty": either the person is a tax resident in Brazil, and is obliged to file annual returns (unless the law exempts them from doing so), or the person is not a resident and does not have to file any returns.

A person can only file returns once they have returned to being a tax resident in Brazil.

We believe it is a good thing, for various reasons, for non-resident investors to be allowed to file income tax returns. In 2020, we even put forward the suggestion of creating a "non-resident investor declaration" for this purpose, a topic we developed in the text "Investing in Brazil: 3 suggestions submitted to the IRS in favor of non-resident investors". But today none of this exists.

5. If I cease to be a tax resident in Brazil, am I obliged to close my bank account?

According to the Central Bank, yes. Under the current rules, the bank must close the pre-existing bank account and, if it wishes, a domiciled abroad account (CDE) in its place. The Receita Federal is indifferent on the subject.

Foreign exchange legislation in Brazil has evolved in a curious way. A non-resident bank account like the CDE only makes sense from a historical perspective, as a way of combating the money laundering practices that led to the Banestado CPI. Our technological advances have outstripped the need for bank account controls, and the Central Bank certainly has better ways of preventing illegal practices. From a technical-political point of view, however, the subject is still taboo.

This topic is important as a means of avoidfrom the point of view of the IRS, that, incorrectly, if you consider the investor who made the tax exit as a tax resident in Brazil.

More recently, some banks have been offering CDE at a more affordable rate. We've already covered this topic in detail in the texts "Non-resident current account: why is it so difficult to open one?" e "The non-resident's dilemma: financial investments in Brazil".

6. As a non-Brazilian resident, how are my investments taxed?

There are two tax regimes provided for by law for non-resident investors: the general regime and special regime ("Investor 4.373"). The issue is correctly regulated by the Internal Revenue Service (RFB Normative Instruction 1.585/2015, arts. 85-87 and 88-99).

For financial investments, taxation under the general regime is the same as for any tax resident in Brazil. For investments on the stock exchange, the law requires that the bank or brokerage house with custody of the investments also be responsible for paying income tax. In this way, investors who make a permanent withdrawal should receive their income net of any taxation, without filing returns, in a manner equivalent to withholding tax.

O special regime, regulated by the CMN Resolution 4.373/2014is a tax relief for big investors. A taxation é much smaller than normalBut there are very strict regulatory requirements. This leads to a high maintenance costsThe only people who have access to it are the few.

We compare taxation under the general regime and the special regime in detail in the text "Declaration of Final Departure in 2021: what it is and why you should do it". Unfortunately, however, it is impossible to make financial investments under the general regime, due to problems with the regulations of the National Monetary Council (CMN). We deal with this point in this text, "The non-resident's dilemma: financial investments in Brazil".

The point is important because it implies knowing that, due to bad regulation, those who make the tax exit will often be in an irregular situation with regard to their financial investments in Brazil.

7. I left the country permanently, but I continued to invest in Brazil while living abroad, keeping the investments as they were, without formally notifying the sources of payment (banks or brokers). Am I in breach?

Unfortunately, yes, for many people. The greatest risk is incorrect cross-referencing of data between the sources of payment and the IRS, so that the Receita system understands the obligation to file an income tax returnas if the investor were still a tax resident in Brazil.

This reason alone has not been enough for them to inspect people in this condition. However, these people can have their CPF "pending regularization", a situation that can lead to the blocking financial resources in Brazil.

The important thing here is avoid this scenario. We dealt with this point in detail in our article on "The non-resident's dilemma: financial investments in Brazil", so it's worth checking it out!

8. When I become a tax resident in Brazil again, will I have to pay tax on everything I earned from investing in Brazil while living abroad?

No, that's a myth. If a person has earned income abroad as a non-resident, the moment he or she regains the status of tax resident in Brazil, there is no longer income, but assets. On returning to the status of tax resident in Brazil, just inform the existing assets at that moment.

A simple example: when a person receives a salary, this is disposable income the moment the employer deposits the amount in the employee's bank account. Once in the bank account, the amount is no longer income, but part of the person's assets.

If the salary was income from abroad that is not taxable in Brazil, when reacquiring tax residency it will suffice to inform them that there is a bank account balance. Assets in Brazil are not taxable. Therefore, reporting the account balance, an asset item, is not a taxable event in Brazil.

The Internal Revenue Service could check a person's assets over several years to see if they are liable to pay any tax in Brazil. But the fact is that if the non-resident earns income abroad, there is no Brazilian income tax to pay. The non-resident does not have to file income tax returns in Brazil during this period, which makes the task of comparison even more difficult for the tax authorities.

There is a lot to be done from a regulatory point of view to avoid the problems of the "non-resident dilemma". In any case, these are important points for those who wish to invest their financial resources in Brazil, or at least keep them invested while living abroad.

News on the horizon for those who want to invest in Brazil while living abroad: the Foreign Exchange Bill, the Central Bank's public consultation and Bill 2.337/2021:

One of my and our team's tasks is to inform the public about the issues we deal with and to get involved in correcting the distortions that the legislation brings. This task includes observing some elements that can lead to practical consequences for those who invest in Brazil from abroad.

On the Central Bank's sideThere are two points to note:

1. PL Exchange:

In 2019, the Central Bank submitted to Congress the PL 5.387/2019nicknamed the "Foreign Exchange Bill". This bill provides for the repeal of all foreign exchange legislation in force, replacing it with a new legal frameworkmodern, and with greater regulatory power for the Central Bank. According to a meeting we had with the Central Bank's Regulatory Department (DEREG) on September 17, 2020, the solution to the problems of the "non-resident dilemma" may come easily once the law comes into force.

2. Public Consultation 79/2020:

During the period from November 12, 2020 to January 29, 2021, the Central Bank opened a public consultation with the aim of improving the regulation of the foreign exchange market. Among the intended changes, several remove difficulties in opening accounts for people domiciled abroad (CDEs), with the stated aim of "increasing efficiency in the provision of services to citizens, as well as companies that interact with foreign countries, (...) in a more competitive, inclusive and innovative environment".

Our firm took part in this Public Consultation to offer two suggestions: (i). allow a person to convert their "normal" bank account into a CDEby notifying the bank that he has become a non-resident; and (ii). correcting regulatory problems that prevent non-resident investors from taking full advantage of the rules of the general regime.

The two points mentioned above remain on hold. The House approved the Foreign Exchange Bill in February 2021 without modificationsThe bill is still pending in the Senate. If it becomes law, there will still be a period of 12 months before it takes effect, and it will be up to the Central Bank to modify exchange regulations to reflect the changes.

Therefore, dthe most optimistic outlookThe changes in the PL Exchange Rate may have effective from the second half of 2022.

There is a chance that the Central Bank will publish the result of Public Consultation 79/2020 in 2021. On the other hand, the Central Bank is obliged to read the hundreds of suggestions received. Therefore, it is expected that it will take a while to issue the rule, given its complexity.

On the National Congress side, o PL 2.337/2021 proposes significant changes that could be worth from January 1st, 2022if the bill becomes law in 2021.

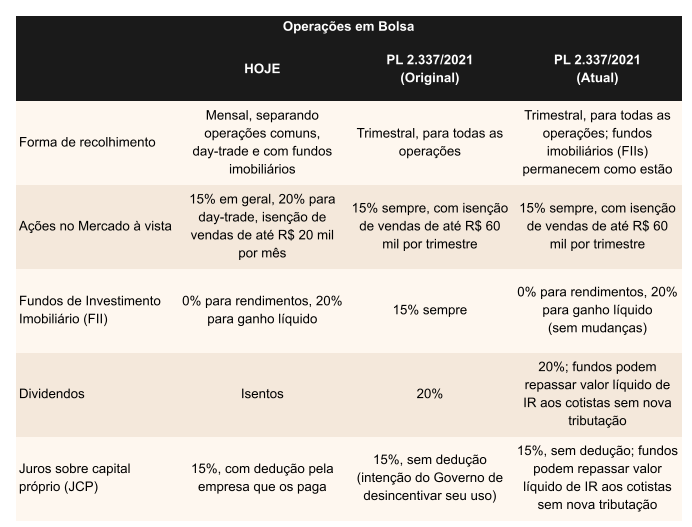

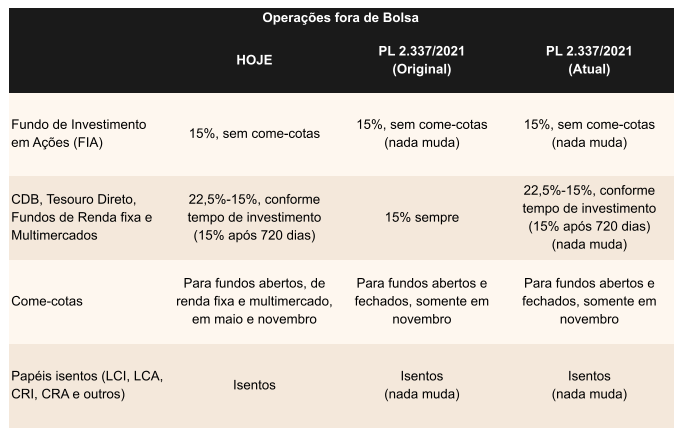

We have already published specific article on PL 2.337/2021and we bring it back here only the points that matter to investors in financial assets in Brazil. In general, the changes simplify the taxation of operations in the financial and capital markets, especially for individuals.

The project is still under discussion, but some of the proposals initially planned have been amended:

It's positive most of the above changes. The way tax is assessed becomes quarterly. What's more, the same rate of 15% applies to ordinary and day-trade operations.

About real estate investment funds (FIIs)

The real estate investment funds (FIIs) Initially, they were to be unified with the other operations, also being taxed at 15%. However, this point has been revised so that there are no changes. For this reason, the calculation of the net gain on the sale of FII shares on the stock exchange remains as it is, i.e. with monthly calculations of net gains, subject to 20%, and, if other requirements are met, exemption on the distribution of FII income to quota holders.

Dividends and interest on equity (JCP)

For dividends and interest on equity (JCP)The proposal in Bill 2.337/2021 remains the same. preventing deductions by the legal entities that pay them and taxing dividends to 20%. On the other hand, the new version of the proposal expressly provides at least that the funds investment companies receiving such income may pass on the net tax amounts to the shareholders without further taxation. This was not provided for in the original version. In the past, the Internal Revenue Service has changed its position on this issue in the transfer of JCP from the fund to shareholders. As a result, the change brings greater legal certainty.

For off-exchange financial investments, the changes are smaller. The initial version of Bill 2.337/2021 envisaged reducing the taxation of financial investments to 15%, which is not the case in the current version. In this case, taxation remains as it is, reducing from 22.5% to 15% depending on the investment period.

On the other hand, the the quota-cutting once a year remainsworth also for closed funds. The percentage of withholding tax for come-cotas remains as it is, depending on the fund's investment period (20% for short-term funds and 15% for long-term funds).

Investing in Brazil while living abroad - Conclusion

There are still difficulties in maintaining financial investments in Brazil, especially for non-residents. This goes against the interests of the state, as well as people who want to invest in Brazil. There is plenty of room for improvement in the rules of the game.

Some changes can be seen on the horizon, but the solution still depends a lot on initiatives by public bodies. For now, for those who want to keep their financial assets organized in Brazil, the only thing left to do is to wait for the changes, knowing the risks (for those who follow the path of permanent exit) or to carry on with life as normal in terms of investments in Brazil, knowing that there may be impacts in Brazil on assets and income kept abroad (for those who maintain dual tax residency).

On this blog you will always find relevant and up-to-date information on the subject, as well as guidance on how to avoid problems with the tax authorities and other authorities. Feel free to tell us about your experience, share the content with other friends who need guidance and contact us by e-mail at contato@tersi.adv.br or via WhatsApp. Click here to send a message now.

Count me in!

A big hug,

Vinicius Tersi

Check out more posts on taxation and estate planning at information for residents abroad.

Author

-

Vinicius Tersi is a lawyer and specialist in international tax law. He also has a degree in Accounting and a Master's in Tax Law from USP, and is familiar with different legal and accounting systems. He specializes in international transactions for entrepreneurs and families with tax residency and assets in multiple jurisdictions. He is qualified to act in Brazil and Portugal.

Home › Forums › Investing in Brazil while living abroad: permanent departure and double tax residence in the taxation of investments