From the firm's experience, we are used to dealing with people who have doubts about how moving abroad affects their investments in Brazil. We talk extensively about tax residence in Brazil and the phenomenon of dual tax residence.

Everything suggests that, as of 2023, we will also need to deal with "foreign exchange residency" in Brazil in order to comply with the Central Bank, in parallel with tax residency with the Receita Federal. Foreign exchange residency affects the foreign exchange market, especially international remittances, the registration of Brazilian capital abroad, the registration of foreign capital in Brazil and the provision of information to the Central Bank.

The aim of this text is to clarify what has just come into force for 20231See BCB Resolution 280/2022.and why we think this is the wrong solution to a simple problem. We took part in the Public Consultation opened by the Central Bank on the subject, but our suggestions were not included. The current content is about what came into force, with still some doubts about what to expect in the future. The Central Bank will still need to develop some routines for us to know how these new rules will be applied in practice.

Tax residency in the foreign exchange market

Until the advent of the New Foreign Exchange Law2Law no. 14.286/2021.The Central Bank used the same criteria as the tax legislation to establish resident status in Brazil, i.e. what the IRS considered to be tax residence would also apply to the foreign exchange market3This link can be seen in article 1 of the Bacen Resolution No. 3.854/2010This article states that individuals who are considered tax residents in the country, according to the criteria of tax legislation, must declare their assets and valuables outside the country to the Central Bank of Brazil..

From 2023, this will no longer be the case. A New Foreign Exchange LawArticle 1 allowed the Central Bank to regulate what the concept of resident means for the "Brazilian foreign exchange market, Brazilian capital abroad, foreign capital in the country and the provision of information to the Central Bank of Brazil, for the purposes of compiling official macroeconomic statistics".

This means that information from how to send money abroad, investing in Brazil while living abroad and how to provide other information to the Central Bank can be handled in one way by the Receita Federal and in another by the Central Bank.

What will be considered Foreign Residence in Brazil?

At the moment (January 2023), we know that the rules that have become effective are the same ones that, in July 2022, the Central Bank proposed in a Public Consultation4See text of Public Consultation No. 90/2022 at Public Consultation SystemClick on the "Closed Consultations" option and search for the consultation number. Unfortunately, the Central Bank doesn't have the best search structure for these documents.. It uses the concept of tax residence provided by the Internal Revenue Service5SRF Normative Instruction 208/2002Articles 2 and 3. as a starting point, but with some important differences and still no details.

To have foreign exchange residency in Brazil, an individual must:

- reside in Brazil on a permanent basis; or

- leave national territory to provide services abroad for the Brazilian Federal Public Administration; or

- if you are a foreigner, you are in Brazil with a residence permit granted for an indefinite period (from the date of entry into the country); or

- being a foreigner, remain in the national territory without rendering services in Brazil as an official of a foreign government; or

- being a foreigner with a temporary visa:

- working as an employee or carrying out an economic activity in Brazil (from the date of entry into the country); or

- remain in Brazil for more than 12 consecutive months (from the date of entry into the country, but may formally manifest to the Central Bank to reduce or increase this period); or

- if you are a non-resident Brazilian, you return to the country permanently (from the date you entered the country, even if you are acting in Brazil as an official of a foreign government); or

- if you are a resident, Brazilian or foreign, you leave the country permanently (from the date you leave the country, if you formally declare this to the Central Bank); or

- being a resident, Brazilian or foreign, to leave the national territory on a temporary basis (from the date of leaving the country or for another period, if he/she formally expresses this to the Central Bank); or

- being a resident, Brazilian or foreign, to leave the national territory on a permanent or temporary basis (during the first 12 consecutive months of absence, if they do not formally manifest to the Central Bank to reduce or increase this period).

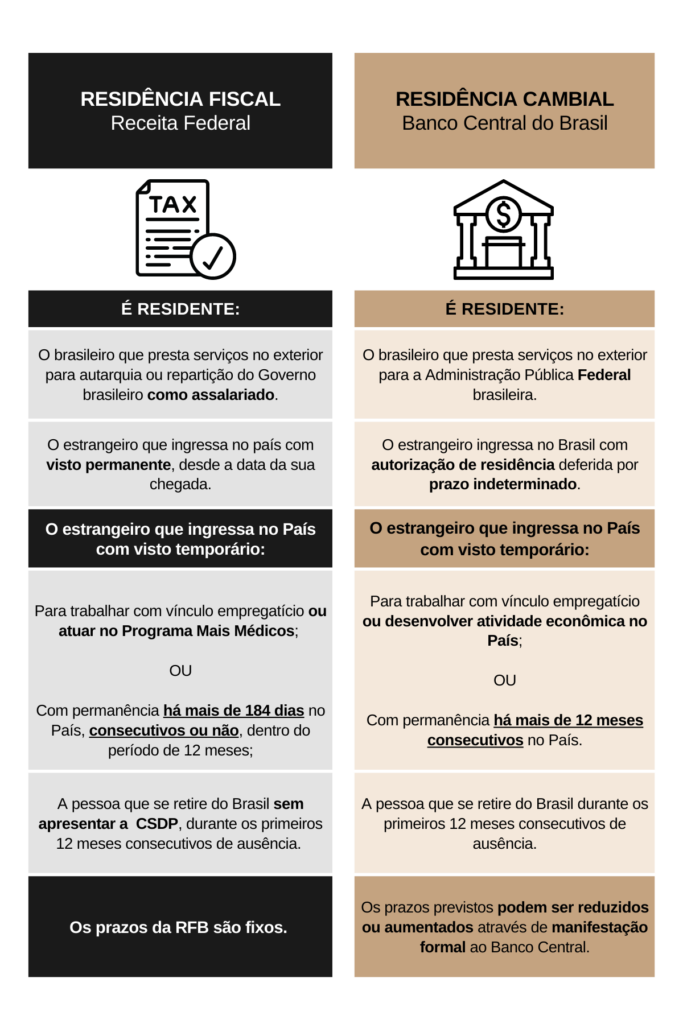

It was then created a twin brother, and almost identical. The Federal Revenue Service and the Central Bank establish, in the same way, that a person who resides in Brazil on a permanent basis is a resident (tax or exchange), and a Brazilian who, after acquiring the status of non-resident, returns to the country permanently.

However, in the other concepts, it is possible to notice small differences between the IRS and the Central Bank:

The difference is tenuous, but pertinent, and adds to the "cloudiness" of the Brazilian rules. The proposal doesn't clarify how a change in the term of foreign exchange residency in Brazil will be formalized for the Central Bank. It seems to suggest a procedure similar to leaving Brazil for good, with a second Declaration of Final Departure from the Country (DSDP)but this time for the Central Bank.

It's very clear that the Central Bank didn't want to cause a sudden change in legislation. On the other hand New Foreign Exchange Law made it possible to be a foreign exchange resident in Brazil and a non-resident for tax purposes, and vice versa.

Why criticize the Central Bank

It may seem like a small problem, but it exposes just how fragile and uncoordinated the relationship between the Central Bank and the Federal Revenue Service is, especially in terms of exchange of information. It is much more logical for a person's information to be requested only once, and to be adopted in the same way for financial investments in Brazil, sending money abroad and tax payments. By creating two different but similar criteria, the chance of error increases, whether that error is made by individuals, institutions or the government itself.

It's very similar to Shakespeare's "Comedy of Errors". Two identical twins, separated in a shipwreck and raised in different places, are mistaken for each other when they stay in the same town.

For example: suppose a bank manager wants to open a bank account for a client who lives abroad but visits Brazil frequently. How will he register the client? In our experience, the word "residence" is usually read as "address", and whether the person's address is in Brazil or abroad determines, in the hands of the manager, the tax treatment applied by the bank (and now the exchange rate as well). So we run the risk of having one reality in the bank's records, another in the tax returns and yet another for the purposes of the Central Bank.

In practice, the New Foreign Exchange Law has ushered in a new comedy of errors, in which the same individual will be considered resident or non-resident according to the cadastral events of their life, especially in international remittances. This problem already exists when it comes to CDE accountAnd it only promises to get worse from 2023 onwards.

Could it be any different?

To be fair, not much. The crux of the problem lies in the lack of collaboration between the Federal Revenue Service and the Central Bank, within their competencies, in the face of a law that is too subjective. On June 26, 2022, our office made the following suggestions to the Central Bank, which unfortunately have not been accepted:

In the short term:

- maintain reference to tax residence rules, without creating a new concept;

- oblige the institution authorized to operate in the foreign exchange market to keep an up-to-date record of the client's address; and

- oblige the same institution to keep, in a separate field, an express indication of whether the person is a tax resident in Brazil or not, using the same information for exchange purposes.

The procedure is already required of Brazilian financial institutions based on the international information exchange agreements in tax and criminal matters, such as FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard). This information is sent to the IRS via a declaration called "e-Financeira".

Nothing prevents the bank from providing the same e-Financeira data to the Central Bank. This would eliminate the need to create an additional obligation, and would prevent the Central Bank from receiving incorrect or discrepant information from those sent to the IRS.

In the long term:

- to carry out a tax reform that will evolve the concept of residence, used as uniformly as possible for tax and exchange purposes.

In this respect, we have already argued that the use of "definite mood" as a criterion for tax residence creates a situation of great uncertainty, given the extremely subjective nature of the concept. There is no need to eliminate the "definite mood", but to reform the existing rules in order to reduce the room for doubt.

A useful way to find common ground between the Federal Revenue Service and the Central Bank would be to combine the concept of civil domicile (already used today) with the concept of residence proposed by the International Monetary Fund (IMF) for investment and foreign exchange statistics worldwide6The IMF's current regulations are set out in "BPM6", i.e. the sixth edition of the Balance of Payments and International Investment Position Manual, p. 70-72.. The Central Bank is obliged to produce statistics in the format required by the IMF, including on the investments of residents and non-residents in our territory.

This topic deserves its own text in the future, rather than being detailed here. In any case, it is preferable to make a change in collaboration with the Ministry of Economy, the Central Bank and the Federal Revenue Service of Brazil, so that the concepts of the two authorities can be close enough to facilitate investments in Brazil. It is likely that the income tax law will have to be amended to allow for the implementation of a BPM6-compatible residency concept for both foreign exchange and tax purposes.

Conclusions

As of 2023, a major change is expected in the foreign exchange market legislation, which will involve the creation of a new concept of "foreign exchange residence", different from the concept of "tax residence" currently used for foreign exchange. This is a symptom of how difficult collaboration between the Central Bank and the Internal Revenue Service has been.

For those who invest in Brazil, an extra level of complexity is expected, which in Brazilian life means an extra layer of doubt and uncertainty. The Comedy of Errors is not the intention of the agents. In Shakespeare's play, the twin brothers wanted to meet to reunite the family in a happy ending. It just so happens that the similarity between the two became the biggest obstacle to achieving this goal.

On this blog you will always find relevant, up-to-date information on the subject and guidance on how to avoid problems with the tax authorities and other authorities. Feel free to tell us about your experience, share the content with other friends who need guidance and contact us by e-mail at contato@tersi.adv.br or via WhatsApp. Click here to send a message now.

Count me in!

References:

- 1

- 2

- 3This link can be seen in article 1 of the Bacen Resolution No. 3.854/2010This article states that individuals who are considered tax residents in the country, according to the criteria of tax legislation, must declare their assets and valuables outside the country to the Central Bank of Brazil.

- 4See text of Public Consultation No. 90/2022 at Public Consultation SystemClick on the "Closed Consultations" option and search for the consultation number. Unfortunately, the Central Bank doesn't have the best search structure for these documents.

- 5SRF Normative Instruction 208/2002Articles 2 and 3.

- 6The IMF's current regulations are set out in "BPM6", i.e. the sixth edition of the Balance of Payments and International Investment Position Manual, p. 70-72.

Home › Forums › Residency and the foreign exchange market: the comedy of errors