Some listed companies offer stock option plans as a form of incentive plan for employees and directors. These plans can be organized in various ways, and I've had the opportunity to analyze some of them over the last 12 years. The most common of these is the granting of stock purchase plan options (the stock purchase plans). stock options), which can be exercised after a few years of employment with the company.

Stock option plans are based on the stock market prices of the company's own shares. For the plan participant, there is an expectation of receiving the appreciation of the shares over the period as a benefit. From the company's point of view, there is an incentive for the participant to achieve targets without the company having to disburse cash.

The incentives themselves are clear, but the applicable legislation is not. There are many questions: is this labor income or a totally speculative commercial operation? What tax is due? By whom, and at what time?

The aim of this text is to clarify, for those who are participants in an incentive plan, how the benefits work and how they are read in Brazilian legislation. Our legislation is silent, but some of the above questions have already been answered by administrative case law.

I would also like to share my personal experience and that of our firm with the main practical problems faced by those who participate in the plans of companies with shares listed abroad. The companies themselves don't always offer clear guidelines. In particular, it is important to inform them, what must be declared in Brazil, when, e when to tax income or gains.

First question: what's your plan?

There are many possible designs for incentive plans. To clarify only the essential concepts, three examples of plans will be described, Plan A, Plan B and Plan C. I don't intend to exhaust all the possible alternatives, just to deal with fairly common situations:

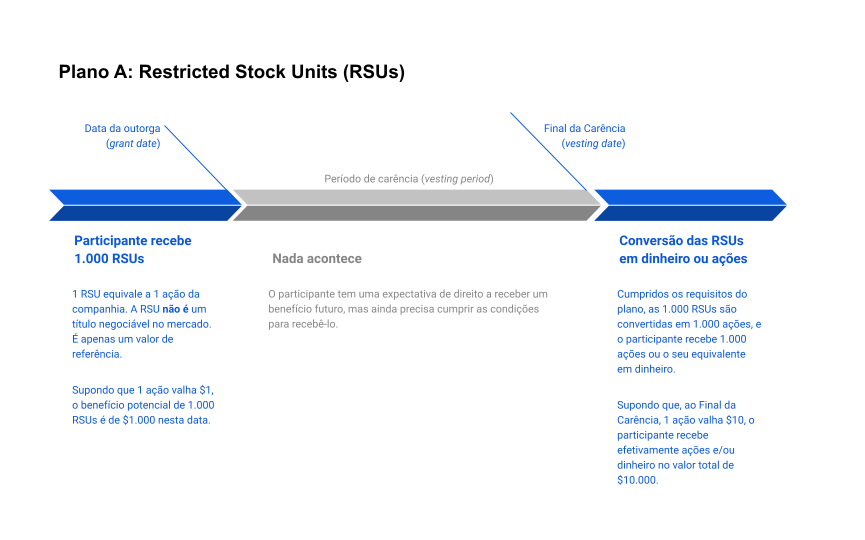

Plan A (Restricted Stock Units - RSUs)

On the day the RSUs were granted (grant date), the participant receives 1,000 RSUs at no cost. Each RSU corresponds to one share in the company. The plan has a 5-year vesting period (vesting period). At the end of the 5 years, if you continue to be linked to the company (vesting date), the participant receives 1,000 shares in the company, or their equivalent in cash. In this case, the value of the benefit is equal to the value of the shares at the end of the period.

It's worth noting that, in the example above, the participant there will always be a gain. In the example above, it doesn't matter what the share price was on the date of the grant. What matters is the value on the date the benefit is received. If the share had fallen in value (from 1TP4Q1 to 1TP4Q0.50 instead of rising in value from 1TP4Q1 to 1TP4Q10), the participant would still have made a gain. The participant may not have any receivables, but they will never take a loss.

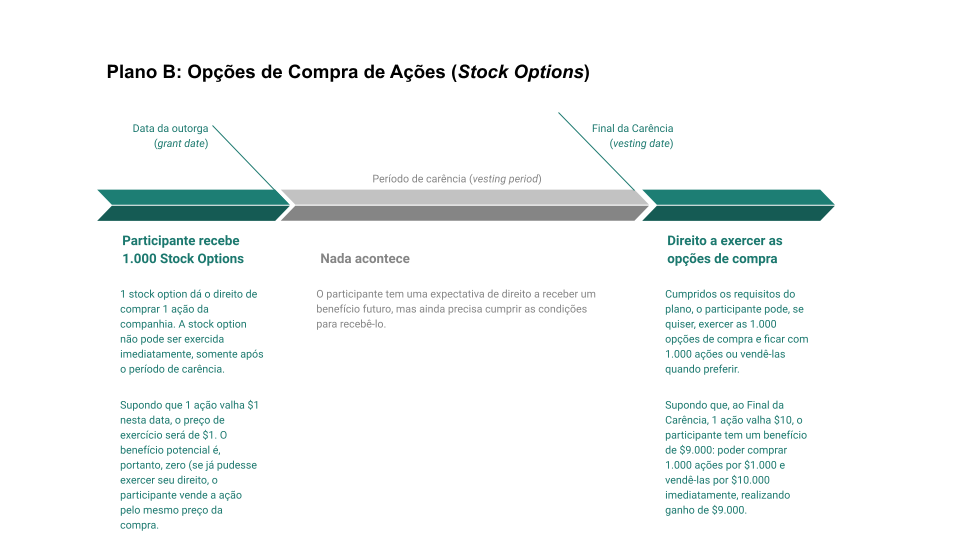

Plan B Stock Options)

On the day of the award (grant date), the participant receives 1,000 call options (stock options) at no cost. Each call option entitles you to acquire 1 share in the company, at an exercise price (exercise price) corresponding to the market value of the share on the grant date. The plan has a vesting period of 5 years (vesting period). At the end of the 5 years, if you continue to be linked to the company (vesting date), the participant can now exercise the 1,000 call options they have received if they wish. When exercising their right, the participant must spend the exercise price. From then on, they can keep the share as any financial investment or sell it immediately on the market, realizing a capital gain.

Unlike the previous example, in this incentive plan the participant doesn't know if he'll make a profit at the end of the period or not. What the participant knows is that if, at the end of the vesting period, the shares are worth more than $1, he will have made a gain. If the shares fall in value to $0.50, there is no point in exercising the right to buy the shares, as you could buy them on the market for less.

Another point is that the gain from Plan B is lower. While in Plan A the participant's benefit is the value of the shares received, in Plan B it is only valuation of the shares during the grace period.

Despite bearing more risk than in the previous example, the participant will only bear a loss if he wants to, as he is not obliged to exercise the call options he wins. The participant does not risk its own resources.

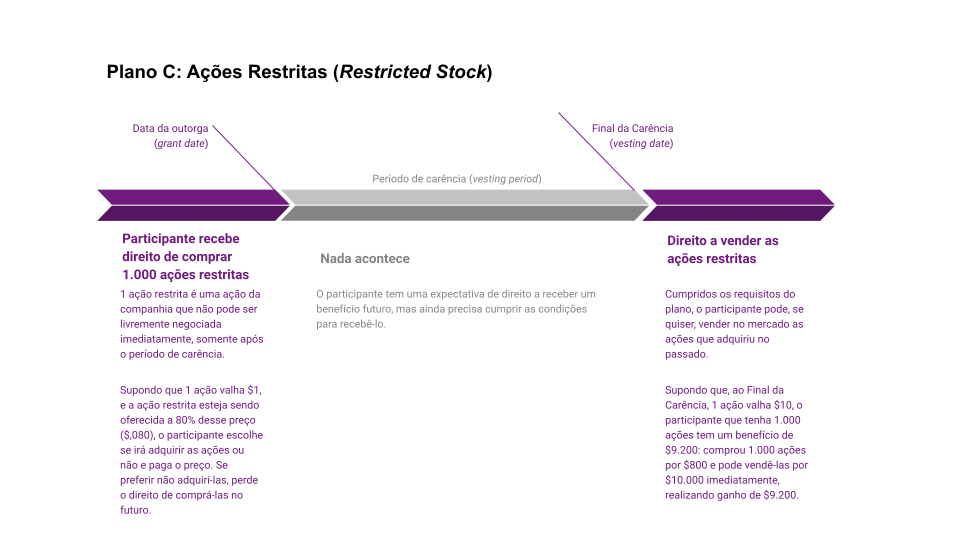

Plan C (Restricted Shares - Restricted Stock)

On the date of granting (grant date), the participant receives the right to buy 1,000 restricted trading shares at a cost of 80% of the market value of the shares on that date. The shares thus purchased cannot be sold. The plan has a vesting period of 5 years (vesting period). The participant can only sell them at the end of the 5 years (vesting date), whether or not they are still linked to the company.

Plan C is different from the two previous incentive plans because it, the participant takes a risk. The participant knows that if, at the end of the grace period, the shares are worth more than the $0.80 he paid, he will have made a gain. He also knows that he acquired the shares for less than they were worth at the time of purchase, but at the same time he couldn't sell them, and so took the risk of devaluation to less than $0.80. If the shares fall to $0.50, you will make a loss. Your gain depends on a situation beyond your control (the appreciation of the company's shares).

The size of the risk will depend on the specific conditions of the plan. If the grace period is very short (1 week), for example, there should only be a loss if the share price falls during the period, which can happen, but is unlikely. However, for a grace period of several years, the risk involved is much greater.

Why analyzing stock option plans is important

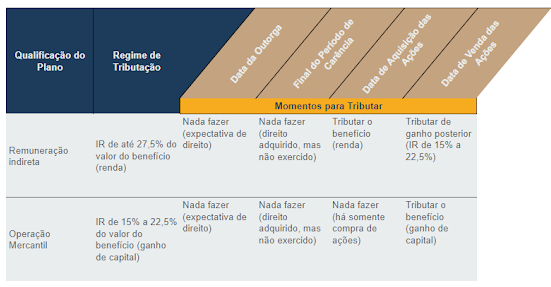

The first aspect discussed in incentive plans is the randomness. This means knowing whether, for the participant, the benefit of the plan represents an indirect form of remuneration for work done for the company or an opportunity for market speculation. In the first case, there is income from work to be taxed; in the second, there is mere trading in shares, and the participant will only have a capital gain in the future.

In Brazil, income tax is up to 27.5% for income from employment, or from 15% for capital gains (rates higher than 15% apply to gains of more than R$ 5 million). Qualifying the type of income means a big difference in the amount of tax.

The second consequence refers to time to tax. Qualified as a capital gain, the tax should only be levied when the shares are sold on the market, not when they are acquired. The participant can pay the tax with the proceeds received from the sale of the shares.

In the case of income from work, the current understanding of Carf (Administrative Council of Tax Appeals) is that income tax will be due when the shares are receivedIn other words, at the end of the vesting period, the participant exercises the call options or receives the shares to which they are entitled. Tax must be paid even if the participant has not realized the gain, i.e. even if they have not received any money and do not intend to sell the shares received.

The table below summarizes the decisions involving the analysis of incentive plans according to Carf case law:

There are other discussions within Carf, such as whether the company is obliged to withhold income tax (IRRF) and pay social security contributions. The focus of this text is only on the participant, so we will assume that they must pay income tax and, with that, declare their income.

Do I have to inform the rights in the Individual Income Tax Return (DIRPF)?

There are many doubts about what to report in the DIRPF, especially when shares or stock options are acquired by the participant free of charge. When should these rights be reported, and for what amount, if nothing has been spent?

There are no precise guidelines from the IRS in this regard. As we mentioned in a previous article on how to declare assets abroadIf the acquisition cost is equal to or greater than R$ 1,000.00 (one thousand reais), the shares and quotas of the same company must be reported. The stock options are neither shares nor quotas, but derivatives, and should therefore be reported if the acquisition cost is equal to or greater than R$ 5,000.00 (five thousand reais).

Therefore, if the stock options or shares have been acquired at no cost, there is no obligation to inform them in the declaration, although there is nothing to prevent this. When the participant spends their own funds to acquire shares or stock options, there is an obligation to declare them for the amount spentwhenever the cost exceeds these limits.

What about when the shares are received in a situation where, according to case law, there is an obligation to recognize and tax the benefit of the plan as indirect remuneration? In this case, the value of the remuneration becomes the acquisition cost of the sharesand this value must be adopted in the declaration of these assets and rights.

In short, if the actions or stock options:

- have been granted to the participant free of charge, there is no obligation to report them in the DIRPF;

- were acquired by the participant with his own resources, they must be reported at the respective cost, and the declaration may be waived if the cost incurred is less than R$ 1,000.00 (for shares) or R$ 5,000.00 (stock options);

- were acquired in a situation where it is understood that there is indirect remuneration, they should be reported taking the value of the indirect remuneration as the cost of acquiring the shares.

In a subsequent transaction in which the shares are sold, the reported cost should be used to calculate the capital gain on the sale of the shares on the market.

Should I report the rights in the Declaration of Brazilian Capital Abroad (DCBE)?

There are cases in which the incentive plan participant receives shares or stock options of shares traded on a foreign stock exchange. If the value of the participant's foreign assets exceeds the minimum threshold of 100,000 US dollars, they must be reported in the DCBE.

The first question is at what point someone becomes the owner of assets or rights that must be reported. Generally speaking, we believe that nothing should be reported as long as there is only an expectation of entitlement (the grant has been made, but the requirements of the plan have not yet been met). Once the requirements have been met, there will be an obligation to inform.

There are two important observations on this subject:

- shares traded on the stock exchange, in a situation where the declarant has less than 10% in the company, must be reported on the "Shares traded on the stock exchange" form. It asks for information on the Trading Market, Currency and Value on the Base Date. It also asks for the amount of dividends received in the year, if any;

- the stock optionsAs they are derivative instruments, they must be reported on the "Derivative - option" tab. This includes the Country, Currency, Valuation Method and Value on the Base Date. The valuation method can be intrinsic (comparison with the value of the share) or extrinsic (an econometric analysis). It is usually simpler to use the intrinsic criterion.

The Central Bank has made available the current version of the DCBE Filling Manual, at this link.

We also recommend reading our text on how to declare assets abroad, which provides more details on the DCBE itself and the fines for late submission of this little-known declaration. In this blog you will always find relevant information and up-to-date information on the subject, as well as guiding you to avoid problems with the tax authorities and other authorities. Feel free to tell us about your experience, share the content with other friends who need guidance and contact us by e-mail at contato@tersi.adv.br, or click here to send a message via WhatsApp now.

Count me in!

Home › Forums › Stock options plans: what they are, how to tax them and how to declare them