When I talk about issues relating to declaration of definitive departure from BrazilIn this article, we answer questions about the situation of real estate in Brazil, especially when you are renting it out. For those who live abroad and receive rent in Brazil, there are no restrictions on buying property. But for non-residents, the rules on renting apply a little differently.

The aim of this text is to provide guidance for those who have made a tax withdrawal or intend to do so and want to know what their situation with real estate becomes after the tax withdrawal, with particular attention to the receipt of rents from Brazil. It is not the purpose of this article to deal with the taxation of non-resident income in general, nor with the taxation of rents in the country where the person lives. That depends on which jurisdiction you live in.

Main differences between residents and non-residents

"I live abroad and receive rent in Brazil": with regard to the situation of properties located in Brazil that are rented out to third parties, the taxation of non-residents is somewhat different from usual, and there are differences between the treatment of tax residents in Brazil and non-residents who have formalized the tax withdrawal. The points below summarize the most relevant aspects on the subject1O Withholding Income Tax Manual - Mafon has been prepared by the IRS to provide this type of guidance. The references to the topic below are on the pages dealing with code 9478 (Rent and Lease from Residents or Domiciled Abroad). The latest version of Mafon is from 2022.:

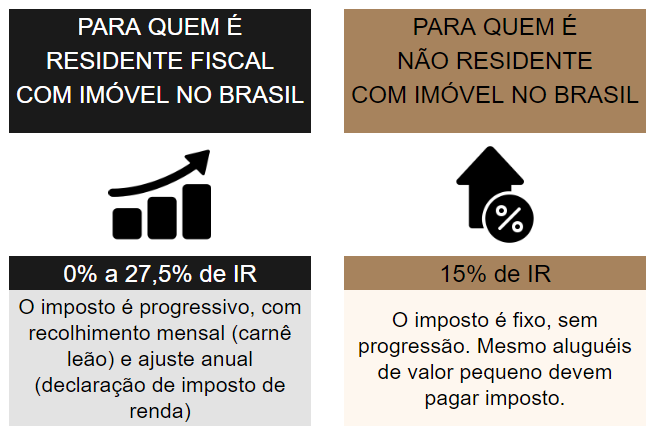

- how much you pay: 15% of income tax, instead of 0% at 27.5%;

- on what you pay: both tax residents in Brazil and non-residents calculate the tax on the rent net of certain expenses provided for by law;

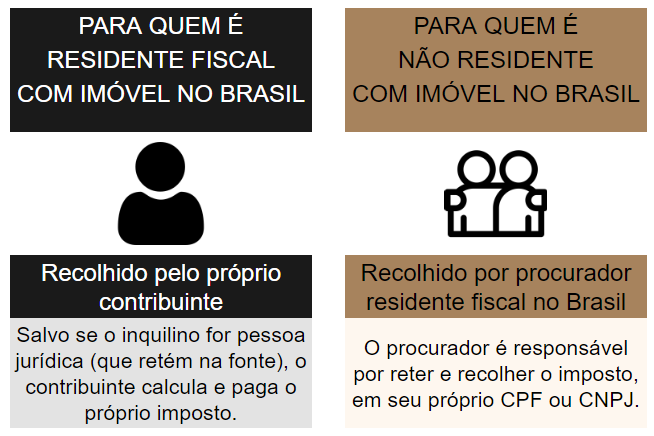

- who pays: the legislation stipulates that a tax resident attorney in Brazil, and not the taxpayer, must pay the tax;

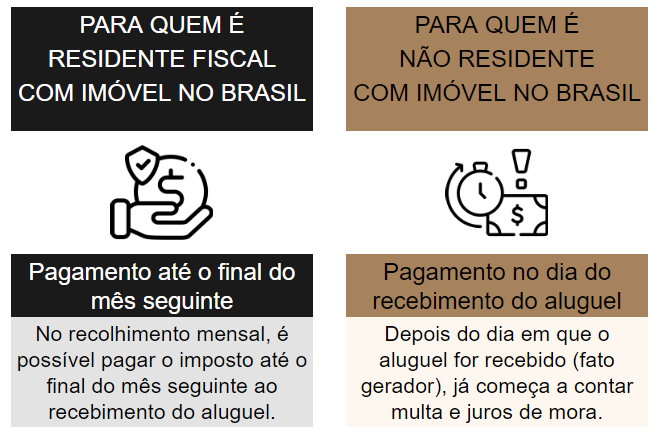

- when you pay: on the same day that the rent is received (date of the taxable event);

- how to declare: not through an income tax return, but through the annual Withholding Tax Return (Dirf).

Below we deal with these topics in a little more detail.

Tax rate: how much tax you pay in Brazil on rented property

The income tax rate on rental properties is 15%. It is worth mentioning that there is no progressive tax rate in this case, which is a difference compared to the tax resident in Brazil.

This means that even small amounts, such as R$ 1,000/month, are not exempt from tax for non-residents.

Calculation basis: on gross or net rent?

Both Brazilian tax residents and non-residents calculate the amount of tax on the same amount. The legislation admits some expenses of the gross rent borne by the landlord. But they are relevant expenses:

- condominium expenses;

- taxes, fees and emoluments levied on the property (IPTU, garbage tax, etc.);

- costs of collecting or receiving the rent itself; and

- rental costs for sublet property, if applicable.

We understand that collection costs include not only the bank slip, for example, but also the commission for the real estate agent who intermediates the payment. In this case, therefore, only the net rent will be subject to 15% of income tax owed by the non-resident.

When I pay income tax on rents

This point often comes as a negative surprise to clients, as the non-resident's deadline is very short. The tax owed by the non-resident must be withheld and collected the same day the rent is received, date of the taxable event.

While tax residents in Brazil have until the end of the following month to pay the tax using the "carnê leão" system (compulsory monthly payment), non-residents are charged late fees (fines and interest) the day after they receive the rent.

The late payment fine is 0.33% per day late (up to a maximum of 20%). Interest is simple, calculated using the SELIC rate, plus 1% for the month or fraction of a month in which the tax is due.

This is a situation in which the law is unfairly suspicious of non-residents. The National Tax Code does not require a law to define the due date for paying tax, but in this case it did. Unfortunately, only with a change in the law can this discrimination be corrected.

How to pay tax on rent received

The situation of real estate rents in Brazil received by non-residents has a unique treatment. A tax resident attorney in Brazil, representing the landlord, has sole responsibility for paying this tax, with DARF code 9478.

As the person liable for tax, the attorney must pay, on your own CPF or CNPJThe amount of income tax on rents. It is not on the CPF of the non-resident landlord.

How to declare income tax to the IRS

So far, there is no requirement in Brazil to file a non-resident income tax return, although we have already forwarded proposal to this effect to the Federal Revenue Service. Thus, the non-resident taxpayer does not declare to the tax authorities the receipt of rents from property located in Brazil.

Instead, the attorney is the one who declares the tax forms for the rents and other information about the non-resident landlord to the tax authorities. This is one of the ways in which the tax authorities are able to cross-check information about rents in this case.

The declaration required to report non-resident income is the Withholding tax return (Dirf)2The IRS offers a manual Questions and Answers about filling in Dirf. Although it is not easy to read, the manual makes it clear that rental income from non-residents must be reported in this declaration.. Delivery is annual. This is not an income tax return. It must be filed by the attorney by the end of February of the year following receipt of the rents.

How to receive rent in Brazil while living abroad

There is nothing to prevent the attorney in Brazil from administering the rents on behalf of the non-resident, receiving the rent, withholding and collecting income tax under DARF code 9478 and remitting the remainder of the rent abroad by means of a foreign exchange transaction.

But that's not practical. There are property expenses to pay, and it may be necessary to keep a reserve in Brazil to meet demands. Our experience with clients is that most of them prefer to keep the funds invested in Brazil in order to carry out their rental management routines, and only occasionally send the money abroad.

It is worth mentioning that, under foreign exchange legislation, the Central Bank stipulates the need for a foreign domiciled account (CDE) as a non-resident bank account. For this reason, such an account would be necessary for the administration of the funds. We found no rules regarding the use of bank accounts by the Receita Federal. This is only required by the Central Bank.

On this blog you will always find relevant, up-to-date information on the subject and guidance on how to avoid problems with the tax authorities and other authorities. Feel free to tell us about your experience, share the content with other friends who need guidance and contact us by e-mail at contato@tersi.adv.br or via WhatsApp. Click here to send a message now.

Count me in!

References:

- 1O Withholding Income Tax Manual - Mafon has been prepared by the IRS to provide this type of guidance. The references to the topic below are on the pages dealing with code 9478 (Rent and Lease from Residents or Domiciled Abroad). The latest version of Mafon is from 2022.

- 2The IRS offers a manual Questions and Answers about filling in Dirf. Although it is not easy to read, the manual makes it clear that rental income from non-residents must be reported in this declaration.

Home › Forums › I live abroad and receive rent in Brazil: what do I do?