In the consultations I give to clients, one of the most basic and least easy points to convey clearly is what it means in practice, making the transition between being a tax resident in Brazil and ceasing to be one. Information on the subject is very sparse, and the Brazilian Federal Revenue Service (RFB) and the Central Bank provide superficial and confusing guidance.

The aim of this text is to deal in more depth with how the transition works between being a tax resident in Brazil and becoming a non-resident after formalizing the Definitive Exit from Brazil. We will deal in a superficial way with how the "definite intention" works, in order to focus only on the change of regime that the transition to non-resident implies.

Before Final Departure from Brazil: obligations of the Tax Resident in Brazil

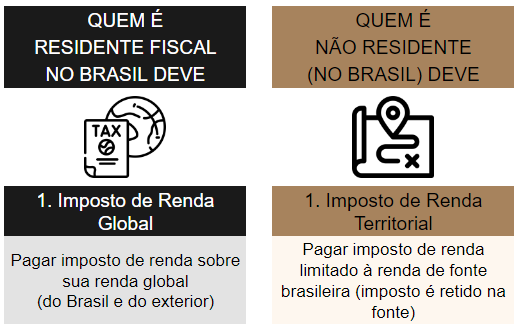

Anyone who is a tax resident in Brazil has a stronger bond with the Brazilian state. This link will be strong enough for the taxpayer to fulfill the obligations of:

- submit all their income to income tax, whether earned in Brazil or abroad ("global taxation");

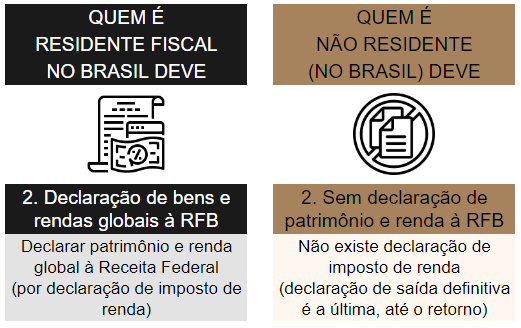

- file an annual personal income tax return (DIRPF), in the form of an Annual Adjustment Statement (DAA), to inform the RFB of said income and also data on their assets and rights, in Brazil and abroad; and

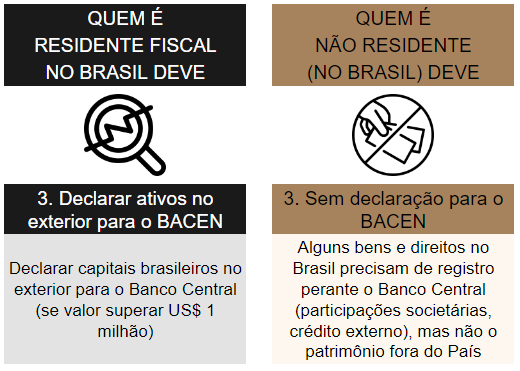

- if all the assets abroad in your name exceed the limit of one million US dollars, submit a declaration of Brazilian capital abroad (DCBE) to BACEN.

These obligations are common to all those who stay in Brazil in a way that is compatible with having a "definite will", i.e. the intention to remain an active participant in Brazilian life. When this link is broken, so that a person no longer has such an active participation in Brazilian society, we are talking about the loss of tax resident status in Brazil, which we prefer to call "tax exit".

What is a tax exit?

The Internal Revenue Service uses the terms "definitive departure from the country", "definitive departure" and "temporary departure" in its regulations. To avoid this confusing terminology, we prefer to talk about "tax exit" whenever a person decides to live and work abroad and therefore cuts ties with Brazil.

Anyone who loses the status of "tax resident" in Brazil becomes a "tax exit". Anyone who "leaves" for tax purposes ceases to be a tax resident and becomes a "non-resident".

After Tax Exit: Non-Resident (in Brazil)

With the tax exit, a date is set on which the taxpayer ceases to be a tax resident in Brazil and becomes a non-resident. This is when the Communication of Final Departure (CSD) and Declaration of Final Departure from the Country (DSDP).

From the moment of tax exit, an individual's link with Brazil changes. This has three important consequences: (i) the limitation of income tax to income from a Brazilian source; (ii) the exemption from filing income tax returns; and (iii) the exemption from filing returns for Brazilian capital abroad.

1. limits: how far the tax authorities can reach after the final departure from Brazil

As we mentioned, tax residents are obliged to submit all their income, whether earned in Brazil or abroad, to Brazilian taxation. With tax exit, the individual's personal link with the Brazilian state is broken. The latter can only exercise sovereignty over events that occur within its own territory:

In other words, the Brazilian tax authorities can only demand income tax on income obtained from a Brazilian source. This is income subject to taxation at source (i.e. for assets and rights located in Brazil, the respective rents, interest, capital gains, etc.).

So who lives abroad and receives rent in BrazilIf you are a resident of Brazil, or hold companies in Brazil as a non-resident, or are otherwise an investor in Brazil, you will still be subject to Brazilian taxation on the income from your investments.

2. The exemption from filing income tax returns in Brazil

It is very common for people who move abroad to continue declaring their assets to the RFB even though this is not the case, becoming apprehensive at the prospect of not declaring assets. But the opposite is true:

After submitting the Declaration of Final Departure from the Country (DSDP), it is no longer necessary to submit any declaration to the tax authorities. In June 2020, we suggest that the IRS create the non-resident investor declaration to facilitate investment in shares in Brazil. The Internal Revenue Service may create an obligation of this kind in the future, but today, nothing of the sort exists. Taxpayers only return to submitting their income tax returns as normal from the year in which they return to being a tax resident in Brazil.

This does not mean that, in the meantime, the tax authorities no longer have the means to cross-check information. It just means that the tax is withheld at source and declared by the sources of income in Brazil to the IRS. In our experience, it is common for people to find themselves in an irregular situation with the tax authorities simply by ignoring this rule.

3. The exemption from submitting declarations to the Central Bank

Most people are unaware of the obligation to submit the Declaration of Brazilian Capital Abroad (DCBE) to the Central Bank. This is because very few people acquire assets abroad.

However, the DCBE does exist, but it is only required of those who are tax residents in Brazil on the base date (as a general rule, December 31st). Thus, those who have made their Final Departure from Brazil no longer need to worry about this issue.

On this blog you will always find relevant, up-to-date information on the subject and guidance on how to avoid problems with the tax authorities and other authorities. Feel free to tell us about your experience, share the content with other friends who need guidance and contact us by e-mail at contato@tersi.adv.br or via WhatsApp. Click here to send a message now.

Count me in!

Home › Forums › Permanent departure from Brazil: is it worth losing your Brazilian tax residency?