A 2nd phase of the Tax Reform IR was released by the government on Friday, June 25, and delivered to Congress.

O PL 2.337/2021, as it has come to be called, focuses mainly on modifying the income tax legislation for individuals and companiesand has its own section on financial market taxation. The rules of the project, if approved before December 31st of this year, will come into force as early as January 1, 2022.

My experience as a lawyer over the last 14 years has always been the same after these announcements: the press and law firms repeat the text of the bill to everyone they can, as quickly as possible. Events are scheduled to inform the public about the changes and to discuss what can be done in advance. And there is a rush to make a series of changes before the end of the year, as a way of protecting against what will happen. This "gymkhana" is inevitable. But not fully met for those who want to follow on their own, the evolution of events.

For this reason, we decided to do something different and more valuable here. Mariana Sinicio e Adriana Benatti are government relations professionals from Sinicio & Benatti Associated ConsultantsThey will be co-authors of this article. Their work involves following political events and, where possible, forwarding proposals and suggestions from the public or interested sectors to members of Congress.

They will give their professional opinion on each political step in the evolution of PL 2.337/2021I'll keep this post updated along the way. A chart will visually show how far the project has progressed, to form expectations about how the year 2022 will be affected by the changes. For income tax, December 31, 2021 is the fatal date to consider.

It will be up to me and other members of our team below to give our legal opinion on the meaning of each important measure to build the personal and family heritage of those who read us.

Specific articles will be posted over the coming weeks to elaborate on our opinion in more detail. And, of course, our team will be at the disposal of anyone who wants to get in touch with us. I hope you, the reader, find this content useful. We are pleased to have written it.

Current status of Bill 2.337/2021

On June 25th, the Minister of Economy Paulo Guedes sent to the Chamber of Deputies a Tax reform. Although the President of the House, Dep. Arthur Lira (PP-AL), has announced the rapporteur of the matter, so far there has been no order to indicate in which collegiate bodies the bill will be considered.

The possible rapporteur, Deputy Celso Sabino (PSDB-PA)The House of Representatives has already held meetings with the economic team and the Internal Revenue Service to discuss the issue. It is expected that the House will set up a special committee for preliminary analysis of the matter - the so-called Special Committee - before it is referred to the House Plenary. However, it's up to President Arthur Lira the designation of processing and give rhythm to your progress. Within this collegiate body, a Rapporteur will be appointed and the other parliamentarians will have space to make suggestions and debate the issue.

Despite the fact that the appointed Rapporteur has a history of dealing with proposals of interest to the government - such as the Emergency PEC (PEC 186/2019), to which he reported and managed to maintain a large part of the proposals defended by the Executive - and that he is close to the IRS and the Centrão, the text will most likely undergo significant changes.

Following the text is of main interest to those most affected by the changes proposed by the PL 2.337/2021 such as 2nd phase of the Tax Reformthat is, those who:

- have income subject to progressive IRPF taxation and benefit from the simplified discount (income from work and rental properties, with few medical expenses to deduct);

- are entrepreneurs, or have investments in the stock market, and are therefore beneficiaries of dividendswith a special rule for micro and small entrepreneurs;

- who has or has received properties with a cost value that is well out of dateas an individual or through a real estate company;

- who maintains financial investmentsfixed or variable income, in funds or on the stock exchange, in particular shares of closed-end investment funds; e

- who has tax residence or assets abroad.

The table below provides information on the current progress of the PL 2.337/2021 on its way to possible conversion into law:

It is worth mentioning that, in order to be valid and effective on January 1, 2022, Bill 2.337/2021 needs to be published by December 31, 2021. 2022 will be an election year, and it's less likely that the bill will go ahead if it can't be approved by then. In any case, if it becomes law in 2022, the changes will only come into effect in 2023.

Updating the IRPF progressive table

The Income tax reform brought some new features, the first being the updating the progressive income tax table for individuals. This is a campaign promise of the Bolsonaro government, in a more timid version.

The promised exemption band was 5 minimum wages, or R$ 5,500 today. During the press conference announcing the Reform Bill, it was explained that there was no fiscal space for all the promised increase, so that is proposing to extend the exempt range to up to R$ 2,500 per month (today it is approx. R$ 1,900).

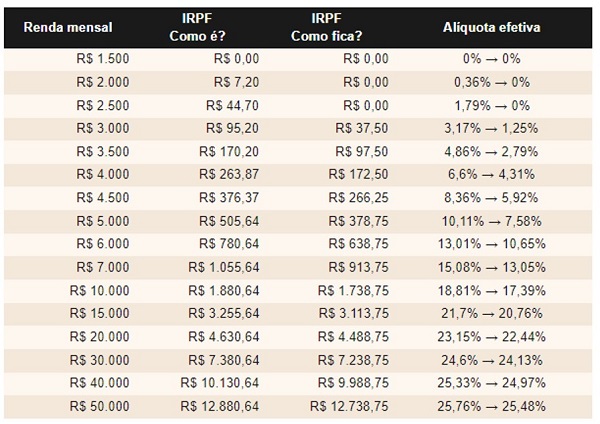

For a better understanding, the progressive table determines the rate to be paid according to the individual's income. The higher the income, the higher the percentage of tax due to the tax authorities. The intention is to maintain the current rates of 0%, 7.5%, 15%, 22.5% and 27.5%, but to extend the smaller bands. This should reduce final taxation. To show this, based on the same example published by the Federal Government:

The change itself is favorable for the taxpayer, but must be offset by tax increases in other areasas will be seen below.

End of the simplified IRPF rebate for almost all taxpayers

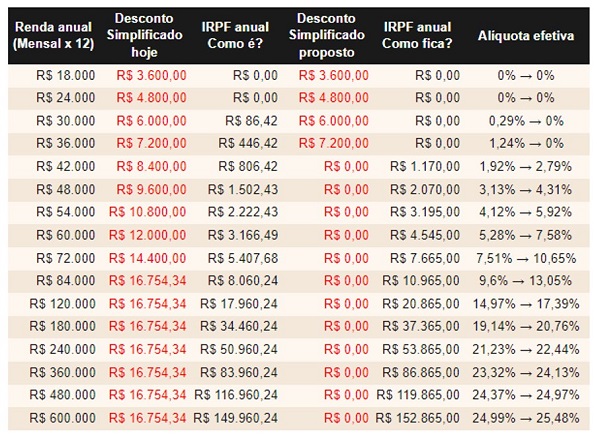

One of the tax increases envisaged by the Income tax reform (PL 2.337/2021) is to introduce limits on the use of the simplified deduction. Today, when preparing an individual's annual income tax return, it is possible to choose to deduct 20% of income taxable by the annual progressive table as a discount, up to a maximum discount of approx. R$ 16 thousand.

The proposal provides for limit the simplified discount only those who earn taxable income from up to R$ 40 thousand per year (equivalent to approximately R$ 3,300 per month). All other taxpayers would be obliged to take legal deductions, subject to verification in fine mesh control, such as medical and educational expenses.

The change to the Tax Reform promises to have two consequences:

- increasing taxation of those who today prefer the simplified discount because it means less tax to pay, i.e, of those with few expenses to deduct;

- intensify the need for proof of fine meshThis should put pressure on consumers to require more invoices to be issued medical services.

The federal government's argument is that the IRS currently makes it easier to fill in the income tax return by giving access to information contained in its database, especially medical expenses.

Despite advances in recent years, the procedure for proving medical expenses is still subject to provocation by the tax authorities and places the burden on the taxpayer. Even those who want to anticipate the fine mesh have to wait until the turn of the year to submit documents, which is a disincentive. If the real intention was to encourage the use of legal deductions, the channel for submitting proof to the tax authorities in advance needs to be simpler than it is today.

It's clear to see that, even with the updating of the progressive table, the change will ultimately lead to a tax increase. The example below considers the update of the progressive table plus the limitation of the simplified discount, with no other deductions to take advantage of:

This phenomenon is the one we mentioned in article in the newspaper Valor Econômico published on 29.06.2021. O biggest increase of taxation is for those with taxable income of R$ 40-80 thousand per year (approx. R$ 3-7 thousand per month)with less effect in higher income brackets.

A main advantage of the simplified discount todayThe aim is to make it easier to fill in the declaration, rather than in terms of values. greater peace of mind with regard to controls fine mesh. Those who have the most to gain from deductions decide to take the risk of proving them. In our opinion, the brazilian income tax return is simpler to fill in than that of other countries in terms of income, but contains very few deductions.

If this were a real reform, there would be a simplification of the monthly tax return rules and greater clarity about the deductions available. Taxpayers would be given greater incentive to report them, with penalties for those who fail to do so. As it stands, the amendment promises only more bureaucracy.

Return of dividend taxation

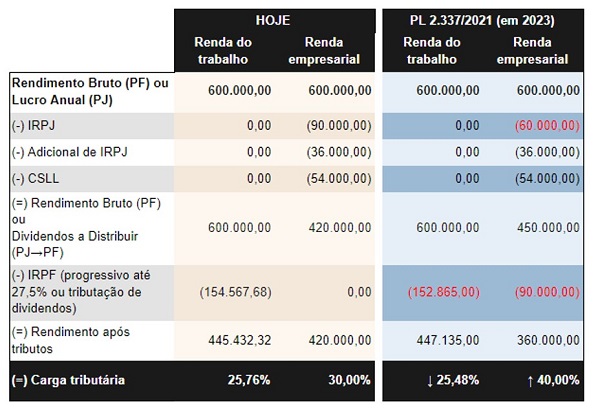

Another promised benefit of the Income tax reform is the reduction of the Corporate Income Tax (IRPJ) rate by 5 percentage points, gradually (2.5% in 2022 and 5% in 2023). The reduction is accompanied, however, by 20% tax on dividends from 2022 onwards, which are currently exempt.

In our opinion, this is worst point in the proposal. We're not against taxing dividends per se. But this issue is complex, and will merit its own text, to be published on July 9, 2021. The proposal promises to return to the insecurity of the period from 1989 to 1995, when legislation on the subject changed several times until the current model was decided upon.

For now, it is worth highlighting how this represents a sharp increase in taxationWhen the taxation of the legal entity is added to the taxation of the partner or shareholder. The table below compares today's situation with that proposed by Bill 2.337/2021 for 2022 and 2023. Let's compare the taxation of labor with the taxation of companies within this scheme (in red the reflection of the change in the law):

As you can see, the current system taxes business income more than labor income. This is one of the reasons why Simples Nacional exists for micro and small companies. The PL 2.337/2021 makes the gap even wider.

At this early stage, it is being discussed whether the rate for dividends should be 10% or 15%, instead of 20% proposed by the tax authorities. Any of these options will still represent an increase in taxation.

It is worth mentioning that the measure affects both small and large entrepreneurs, regardless of the company's choice of tax regime (Simples Nacional, Lucro Presumido or Lucro Real). For micro and small companies in the form of Complementary Law 123/2006The proposal is to exempt profits of up to R$ 20,000 per month, which will require greater control through ancillary obligations.

Small and large stock market investors will also be affectedThe proposed exemption of R$ 20,000 per month on dividends does not apply here. The proposed exemption of R$ 20,000 per month on dividends does not apply here.

The proposal is also accompanied by an update of the disguised profit distribution rulesIt is now almost out of use. The aim is to prevent taxpayers from generating expenses in the company in favor of partners and administrators in order to evade taxation on dividends. This brings back the greatest complexity of our system before 1996.

Finally, the proposal to Income tax reform has no transition rule. This means that retained earnings until December 31, 2021not distributed as dividends up to that date, would also be taxed from 2022. This goes against previous legislation, in which dividends follow the same taxation rule as the year of the profits that formed them.

Updating property values and ending advantages for real estate companies

The Income tax reform also gives taxpayers the option of updating the value of real estate located in Brazil. Normally, real estate is declared at cost value, and the appreciation in value of the property is taxed when the property is sold to another person. The following requirements apply:

- the taxpayer must be an individual resident for tax purposes in Brazil;

- the property must have been acquired with funds of lawful origin by December 31, 2020 and declared in the corresponding Income Tax Return;

- the option to update must be made during the period from January 1 to April 29, 2022;

- on the value 5% of IRPF must be paid on the difference positive between the acquisition cost and the discounted value.

It is a Minister Paulo Guedes' old proposalalready mentioned in our article of June 3, 2019. A similar measure was taken in 1992, by Law 8.383/1991, and was included in PLS 01/2017, a Senate bill authored by Senator Flexa Ribeiro (PSDB-PA), who wanted the tax to be 10%.

It's a measure to anticipate revenue, proposing lower taxation for a limited time. Under the normal rules, you pay 15% to 22.5% on the capital gain on the sale of real estate, with some reductions depending on the time elapsed between the acquisition and sale of the property.

Take up the option it could be worth itBut it will mean giving up the capital gain reducers applicable to the period prior to the date of opting for this benefit. Therefore, it is worth comparing the benefit with the effective taxation, today, of the property if it were sold. For real estate acquired many years ago, it may not make sense. We will deal with this point in own textmore detailed, on July 16, 2021.

Discreet proposal from Income tax reform is the mandatory real profit for real estate companies. These are companies with more than half of its gross revenue comes from rental income and buying and selling real estate (with the exception of real estate development).

It is a tax planning for families with real estatewhich may no longer be attractive. The tax burden for leasing real estate to a company opting for presumed profit is usually lower than carrying out the same activity as an individual (up to 14.53%, compared to up to 27.5%). If the change is approved, there may be less incentive to organize family holding companies in order to organize the succession of real estate assets.

Other business activities are also subject to this treatment, such as credit securitization, exploitation of copyright or image rights, name, brand or voice, among others.

Changes to the taxation of financial investments

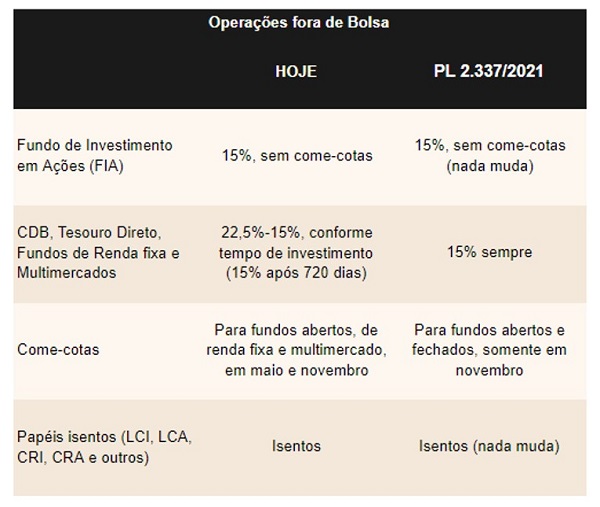

As far as financial investments are concerned, the Income tax reform proposes various changes with significant impacts, especially for individual investors. Most of the changes simplifies the taxation of financial and capital market operations.

We will deal with this point in own textmore detailed, on July 23, 2021. For now, the table below summarizes the differences for the main returns from off-exchange operations:

As you can see, here the project reduces current taxation to 15%. In addition, for the majority of funds, the annual rather than six-monthly collection of the come-cotas allows the more income is accumulated by the funds before funds are brought forward to the tax authorities. The exception is for closed-end funds, which today do not have come-cotas, a subject dealt with in more detail below.

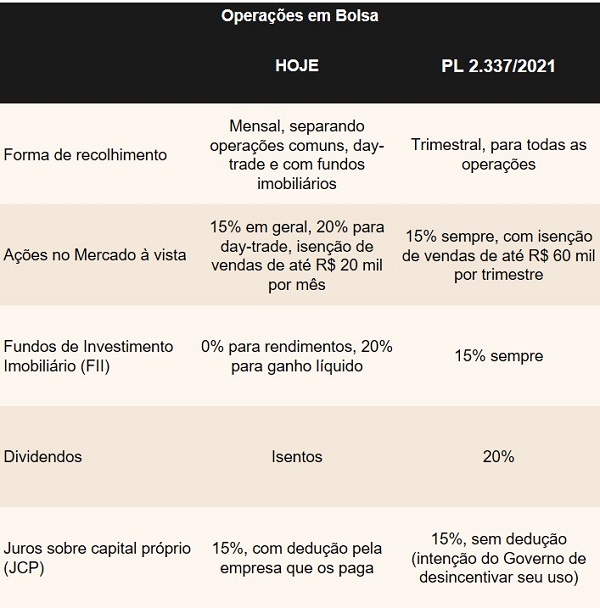

Stock exchange operations, meanwhile, are undergoing more profound changes:

Almost all of the above changes are positiveThey also make it possible to offset losses from any type of stock market operation.

The exceptions are real estate fundsThe bill also exempts real estate investment trusts, which will no longer have their income exempted when traded on the stock exchange. The exemption was thought up when this figure was created by legislation, to encourage the funding of real estate operations, and finds parallels with instruments in other countries, such as REITs in the United States (Real Estate Investment Trusts).

In Brazil, the main use of real estate funds is to transfer real estate assets to the market, so that companies can pay rents instead of keeping the properties in their assets. But several other potential uses of real estate funds could be explored by legislation. Real estate funds are not usually the best instruments, for example, to raise funds for new real estate developments, although they do have that potential. In any case, the measure equates real estate funds with other securities traded on the stock exchange.

The second important (and negative) change is the change in the treatment of dividends and interest on equity (JCP). The issue of dividends, already discussed above, will certainly have a significant impact, and has already been priced in by the financial market following the government's announcement. With the increase in the tax burden on Brazilian companies, the share holders will receive less income.

The JCP remained a limited instrumentThe use of JCP is interesting for open companies or for companies opting for the real profit regime that have non-resident partners, because of the tax advantage. The government's discouragement of its use already comes from tax discussions about this income, such as the (im)possibility of distributing interest on capital based on accumulated profits from previous years.

The reasons for discouraging JCP as proposed by the government are quite valid, but they deserve to be dealt with as part of a more in-depth reform of the role of dividends within our personal and corporate tax system. Simply kill them, as is the intention here, misses an opportunity for deeper reform.

Taxation of closed-end funds

As mentioned above, the Income tax reform also applies to closed-end investment funds, i.e. those organized by the investors themselves, with a personalized investment policy, within the specific rules laid down by the CVM (Securities and Exchange Commission). Also in this category are exclusive funds, i.e. those with only one shareholder.

In this type of fund, shares are only redeemed at the end of the fund's term (or once a year), and the entry and exit of shareholders is not permitted. Unlike other funds, tax is not paid to the tax authorities in advance by means of "come-cotas", but only on the redemption, liquidation or amortization of shares. The tax rates are the same, from 22.5% to 15% depending on the investment period (15% after 720 days).

Because of the cost of setting up and maintaining them, closed-end funds are an alternative used only by high net worth individuals and families. Its current use is as a measure of tax and inheritance planning (shares of a fund are transferred instead of each individual financial asset).

At the time the current rules were created, the aim was to stimulate investment in the financial and capital markets. With PL 2.337/2021, this incentive disappears, making closed-end funds the same as other investment funds.. The measure should also affect the financial services industry itself, given that the tax advantage of closed-end funds compared to other funds remains an important attraction.

This project has already been presented in the past, on the occasion of the Provisional Measure 806/2017The bill was never converted into law. At the time, there was also an attempt to create a come-cotas tax for closed funds. What was unpleasant at the time was the taxation of all income accrued and not yet distributed before the change in the law.

O PL 2.337/2021 wants the same thingBut in a friendlier way: it was foreseen that the income tax withheld at source by the fund administrator, at the rate of 15%It must be paid by May 2022. For those who still want to in January 2022 collect the tax, it will be allowed to charge only 10% income tax instead of 15%.

In general, it can be said that the measure can be challenged in courtThis is because it retroactively applies to events prior to the new law. In any case, lower taxation probably should reduce resistance from taxpayers to this measure.

Taxation of events occurring abroad

For those who are not resident in Brazil or who hold assets abroad, the bill of Income tax reform also impacts in various ways, to be dealt with in own article, to be published on July 30, 2021.

For now, it is worth mentioning the following points, which are of interest to non-residents with assets in Brazil:

- the taxation of dividends distributed by a company in Brazil to a partner or shareholder abroad has been proposed for 20%, or 30% if destined for tax havens and privileged tax regimes;

- the agreements signed by Brazil to avoid double taxation limit this taxation to a ceiling. Normally this ceiling is up to 15%, which can be reduced to 10% in specific cases. Each international agreement must be analyzed separately;

- several of the same international agreements lay down rules on matching creditIn addition, a tax benefit within the agreement itself, in the form of a presumed credit for offsetting against the tax due in the other country. Once again, each international agreement must be analyzed separately;

- transactions structured abroad involving the indirect transfer of assets located in Brazil will now be taxable in Brazil as indirect capital gains, at rates of 15% to 22.5%.

In addition to the above measures, Bill 2.337/2017 proposes changes of interest to residents in Brazil with assets located abroad:

- automatic distribution of profits from a company abroad, when located in a tax haven or benefiting from a privileged tax regime. Taxation would be by the "carnê leão" (up to 27.5%), and the exchange variation between the profit distributed and the amount actually remitted to Brazil would be taxable as a capital gain (from 15% to 22.5%); and

- the payment or return of capital through the delivery of goods and rights could only be done at market value, paying tax on the capital gain, from 15% to 22.5%. Current legislation allows transfer at the respective acquisition cost, deferring taxation to a future date.

The first of the above proposals has already been included in the Provisional Measure 627/2013The second point is consistent with the return to taxation of dividends and the problems with disguised profit distribution rules. The second point is consistent with the return of taxation on dividends and the problems with disguised profit distribution rules.

Finally, it is also proposed eliminate the exemption for capital gain on the sale of goods located abroad, when acquired as a non-residentThis exemption is currently in place. This exemption is very useful for planning a return to tax residency in Brazil. Certainly the end of the exemption will jeopardize the transition back to the country.

Conclusion

Unlike other tax reform bills IR in Congress, PL 2.337/2021 doesn't seem to deserve the name. The structure of Brazilian income tax will remain the same, with major and minor adjustments. There are certainly positive adjustments, such as simplifying the taxation of the financial market. But we also have the return of problems from our system's past that should now be overcome, such as the return of taxation on dividends.

Despite the argument to the press that the government is not proposing to increase the tax burden, the argument is not convincing. O tax burden becomes greater on business activity, which, like it or not, is the biggest generator of jobs and income for society as a whole.

If the CSLL were eliminated and any other dividend taxation model available in the world were chosen, there would be a de facto reform and more reason for optimism. Today's bill, however, it's just another proposal from the tax authorities, by the tax authorities and for the tax authorities, to the detriment of Brazilian society. We deserved more than that.

For now, all that remains is to follow events and, once again, be prepared for the occasion. From us, let's follow closely.

On this blog you will always find information relevant and up-to-date on the IR Tax Reform, as well as providing guidance on how to avoid problems with the tax authorities and other authorities. Feel free to tell us about your experience, share the content with other friends who need guidance and contact us by e-mail at contato@tersi.adv.br or via WhatsApp. Click here to send a message now.

Check out more posts on taxation and estate planning at information for residents abroad.

Count me in!

A big hug,

Vinicius Tersi, Mariana Sinicio and Adriana Benatti

This text about Income tax reform was prepared by Vinícius Tersi Advocacia, a law firm specializing in International Tax Consulting.

Home › Forums › Income Tax Reform: What Changes with the New Proposal